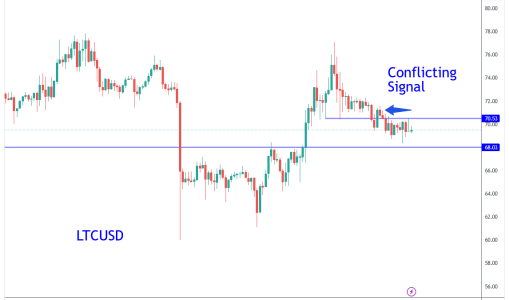

Litecoin (LTCUSD): Higher Low But Conflicting Signal.

- Marc Principato

- January 17, 2024

Litecoin (LTCUSD): Higher Low But Conflicting Signal. Litecoin (LTCUSD 4 Hour): Selected as Trade Of The Week but as Bitcoin came off its high, LTC has failed to follow through (see conflicting signal on chart). These signals are momentum based which means the price action that follows the signal should be green in the case of a bullish momentum reversal. When momentum fails, it is usually a good idea to take an early exit rather than taking the full stop. See chart here: https://www.tradingview.com/x/hyO9YLKH/ As of now, price is still managing to hold above the 68 support level which likely coincides with Bitcoin 40K. As long as this key support holds, another bullish leg is still probable. Bitcoin will have to lead the way. IF 68 is compromised, avoid any new longs until a confirmation of stability appears.